Watch MRKT Call:

ICYMI: Friday afternoon Dan, Guy & Carter outlined three trade ideas using options (TLT, UUP, XLE) and discussed why these assets could be the driving force behind the market in Q4 (see below for trade ideas & rationale).

Plus, tune in today at 12 pm ET for MRKT Call on SiriusXM channel 132 and call 844-942-7866 if you have any questions!

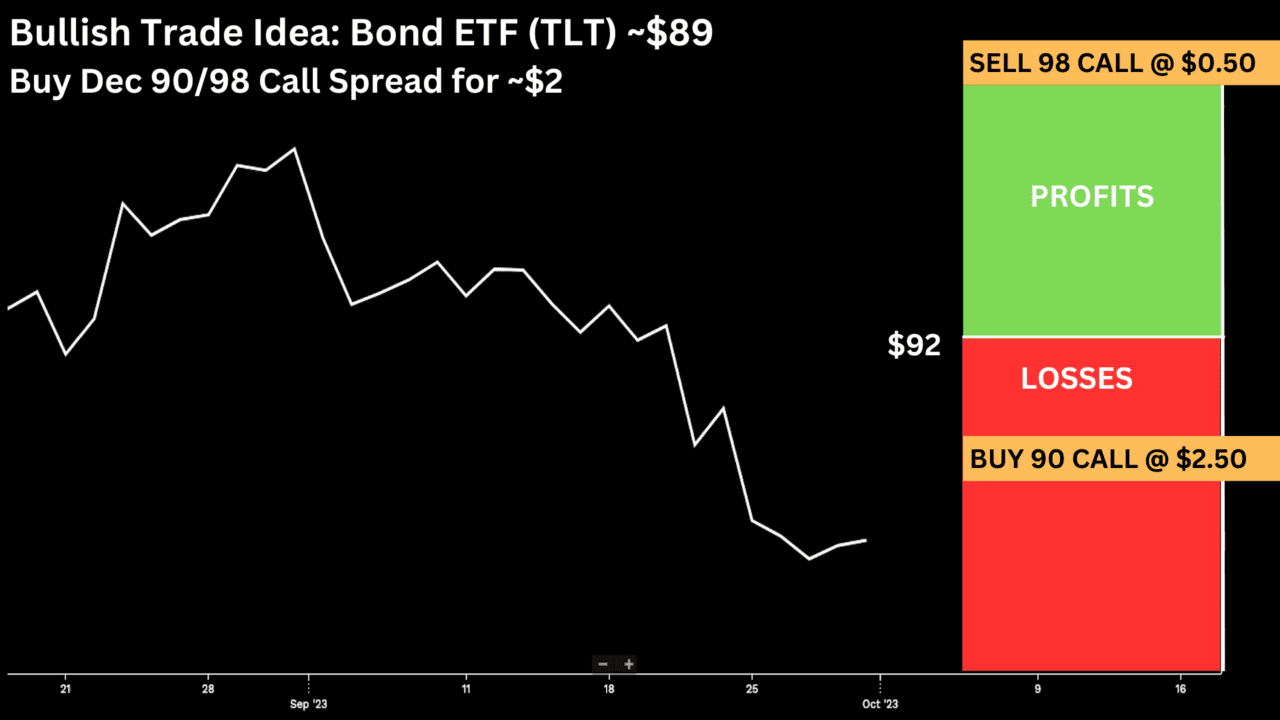

TLT ($89) Buy Dec 90 – 98 call spread for ~$2

- Buy to open 1 Dec 90 call for ~$2.50

- Sell to open 1 Dec 98 call at ~50 cents

Break-even on Dec Expiration:

- Profits of up to 6 between 92 and 98 with a max gain of 6 at 98 or higher

- Losses of up to 2 between 90 and 92 with a max loss of 2 below 90

Trade Rationale:

- This trade idea risks 2.2% of the ETF price, with a break-even up of 3.3% and a max potential gain of nearly 7%

- If the ETF is up ~10% in two and half months

- Risks 2 to make 6

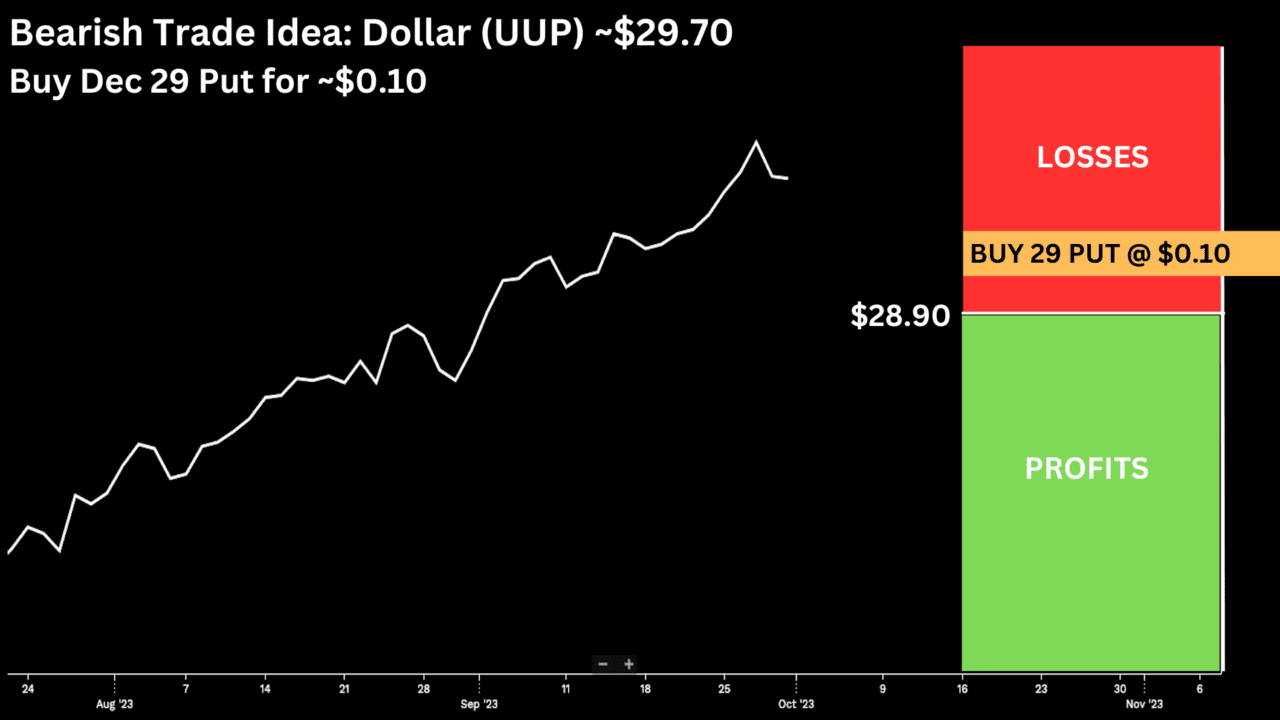

UUP ($29.70) Buy Dec 29 put for 10 cents

Break-even on Dec Expiration:

- Profits below 28.90

- Losses of up to 10 cents between 28.90 and 29

Rationale:

- This trade has about a 20% probability of being in the money on December expiration but an attractive risk-reward if the dollar were to have a precipitous drop in the next two months

- Retracing the move of the last two months

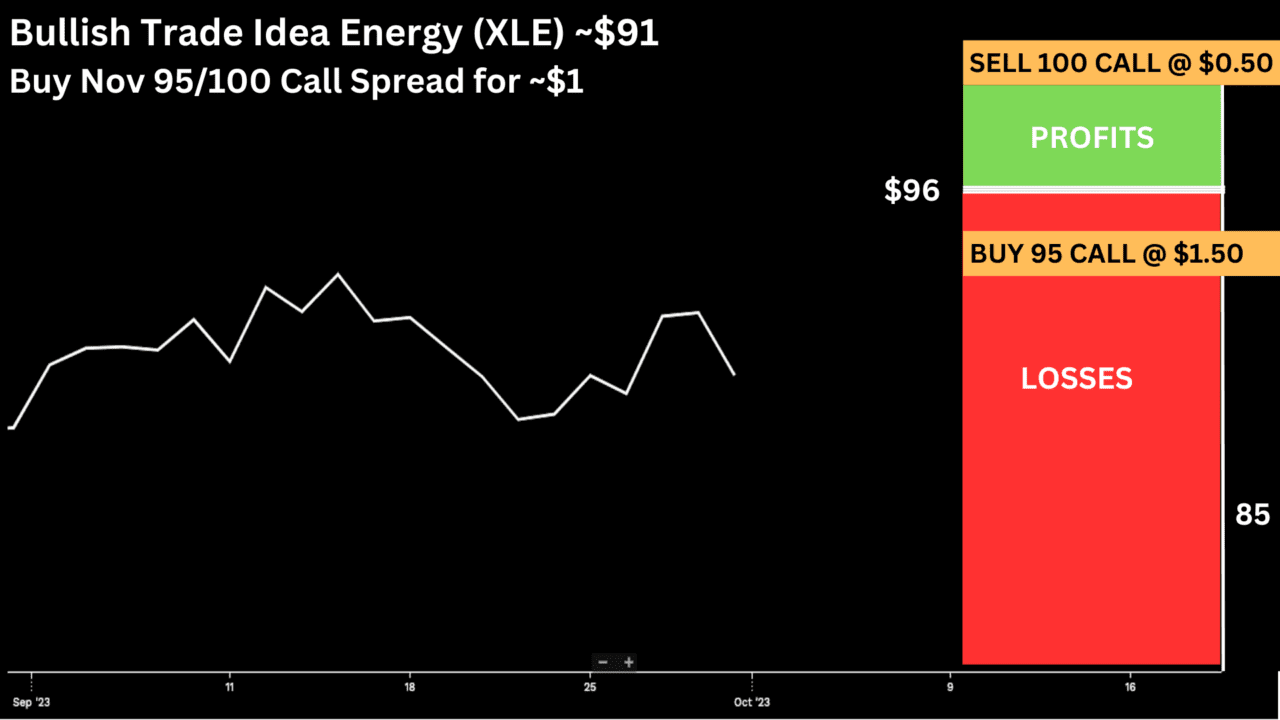

XLE (~$91) Buy Nov 95 – 100 call spread for ~$1

- Buy to open 1 Nov 95 call for ~1.50

- Sell to open 1 Nov 100 call at ~50 cents

Break-even on Nov expiration:

- Profits of up to 4 between 96 and 100 with a max gain of 4 above 100

- Losses of up to 1 between 95 and 96 with a max loss of 1 below 95

Rationale:

- This trade idea risks ~1% of the ETF price and has a break-even up ~5.5% with a max gain of ~4.5%, up 10%

- The options market is suggesting there is only a 15% chance of a max gain, but it is a decent risk reward if you think some event lurking could cause a spike in oil, causing the stocks to follow.