Guy Adami and I are back with the Macro Setup brought to you by our presenting sponsor Nadex, the leading U.S. exchange in binary options, knockouts, and call spreads.

Topics:

To Taper or Not to Taper?

the Fed should seriously consider following the Bank of Canada’s example by initiating a gradual and careful retreat. The longer it takes to do so, the harder it will be to pull off an eventual normalization without risking both significant market volatility and damaging what should and must be a durable and inclusive economic recovery.

Inflation Transitory, a near-term overshoot or here to stay?

Economists and policymakers are carefully tracking the shortages as they hunt for signs of inflation, and companies are increasingly worried that the price spikes may not be temporary.

…

For now, the Fed is not overly concerned about the price increases, viewing them as temporary and not the type of inflation that could spiral out of control. The Fed chair, Jerome H. Powell, said last week that officials expected to see short-lived price spikes as the economy reopened and consumers started spending again.

Geopolitical Risks?

Geopolitical issues that the U.K. said “threaten to undermine democracy, freedoms and human rights” will be on the agenda Tuesday, including “relations with Russia, China, and Iran, as well as the crisis in Myanmar, the violence in Ethiopia, and the ongoing war in Syria,” the government said in a statement.

CHARTS:

SPX 1yr

NDX 1yr

AAPL 1yr

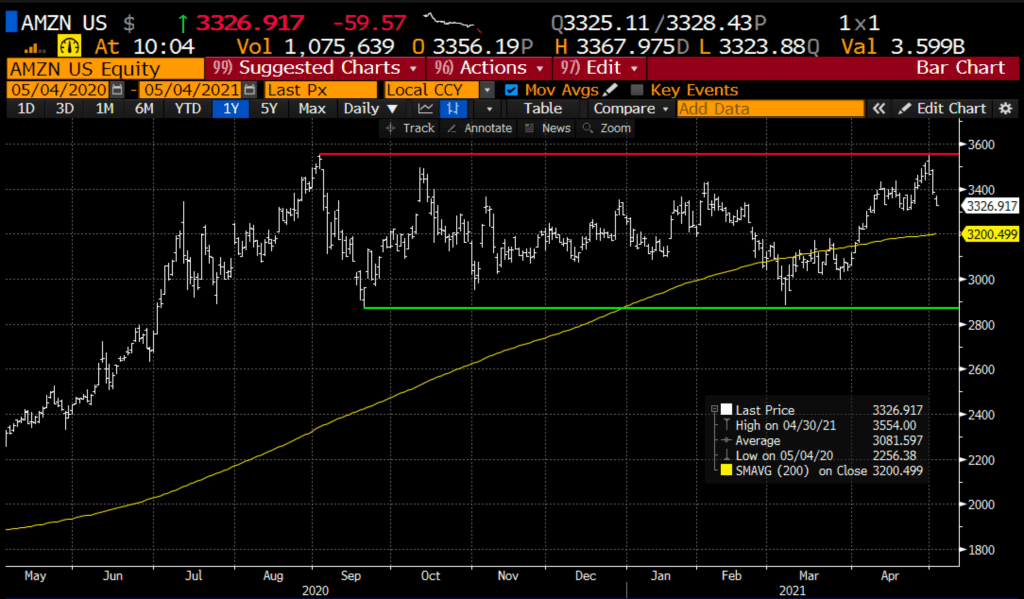

AMZN 1yr

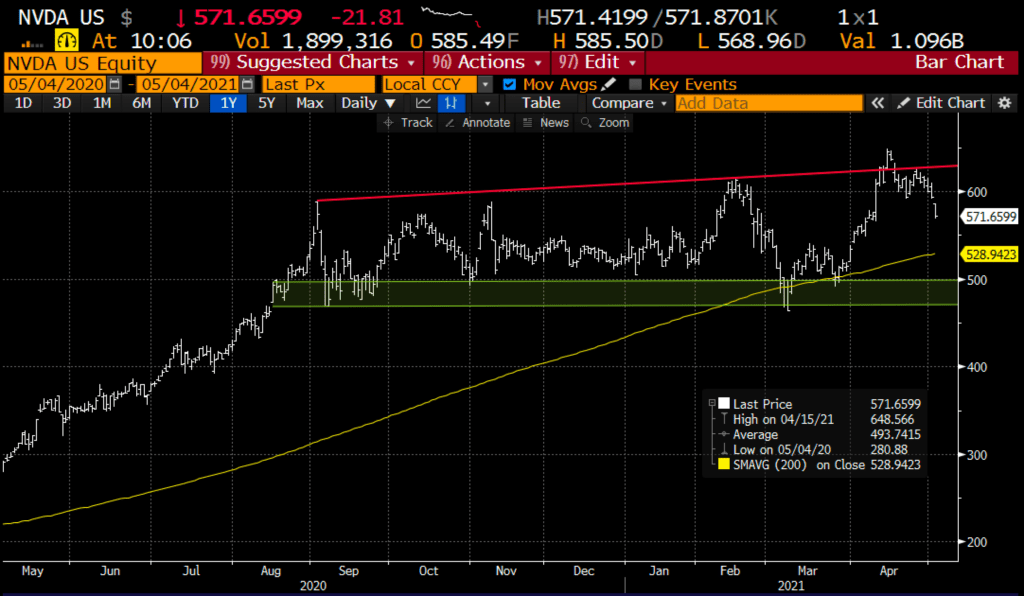

NVDA 1yr

ZM 1yr

PTON 1yr

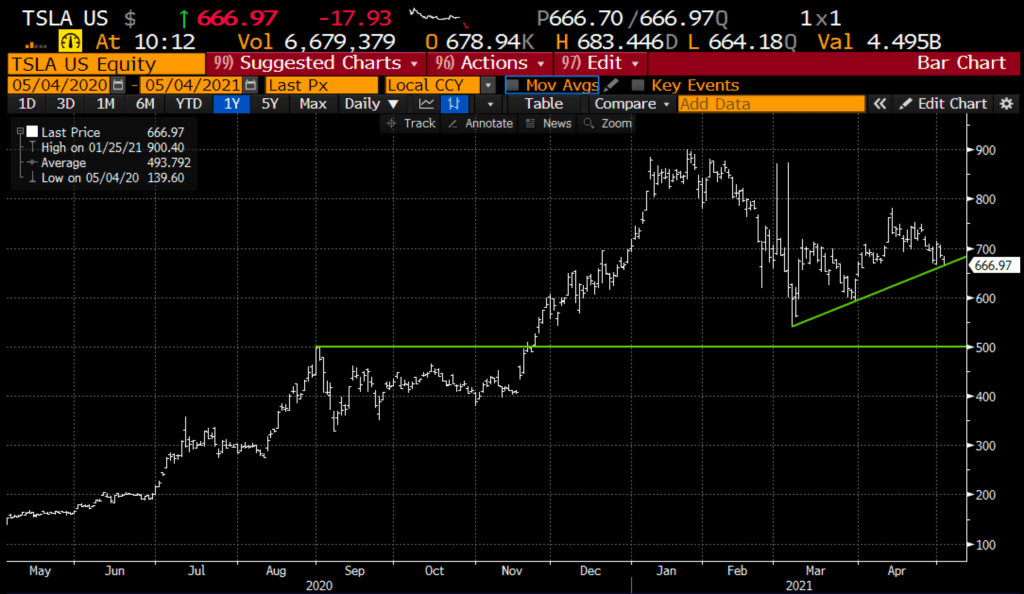

TSLA 1yr

SPAC Index (down 25% from ath)

IPO Index (down 24% from ath)

XME (materials and mining etf) 5yr

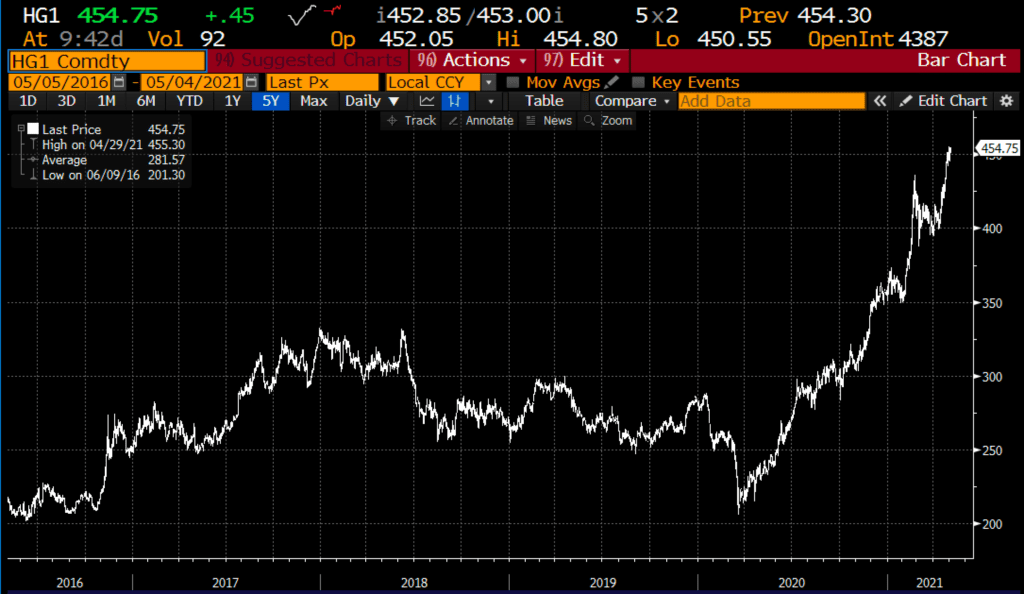

Copper 5yr

Bitcoin 1yr

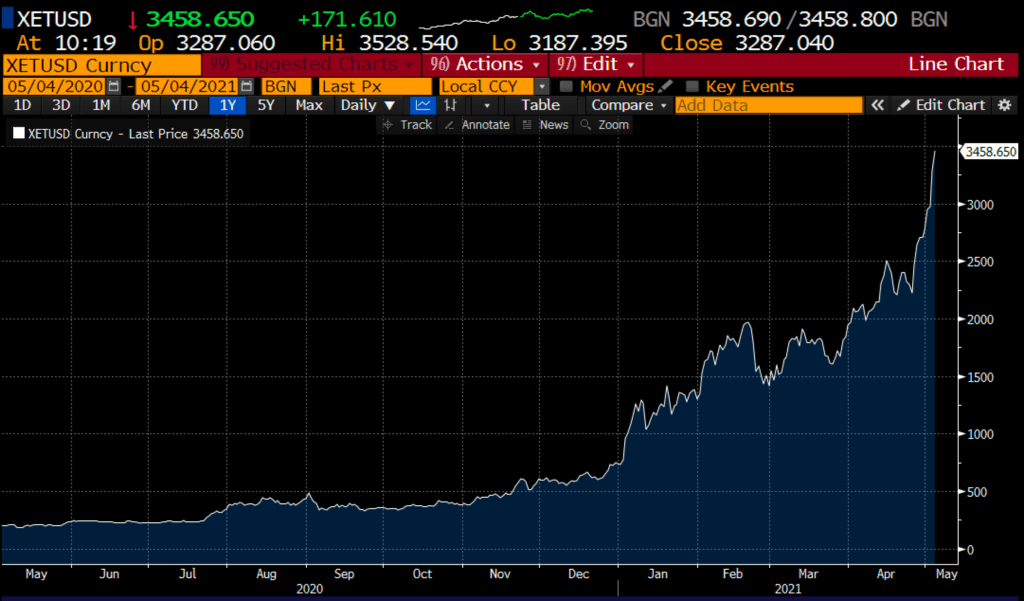

Ethereum 1yr

XAU (Gold yr)

10yr UST Yield

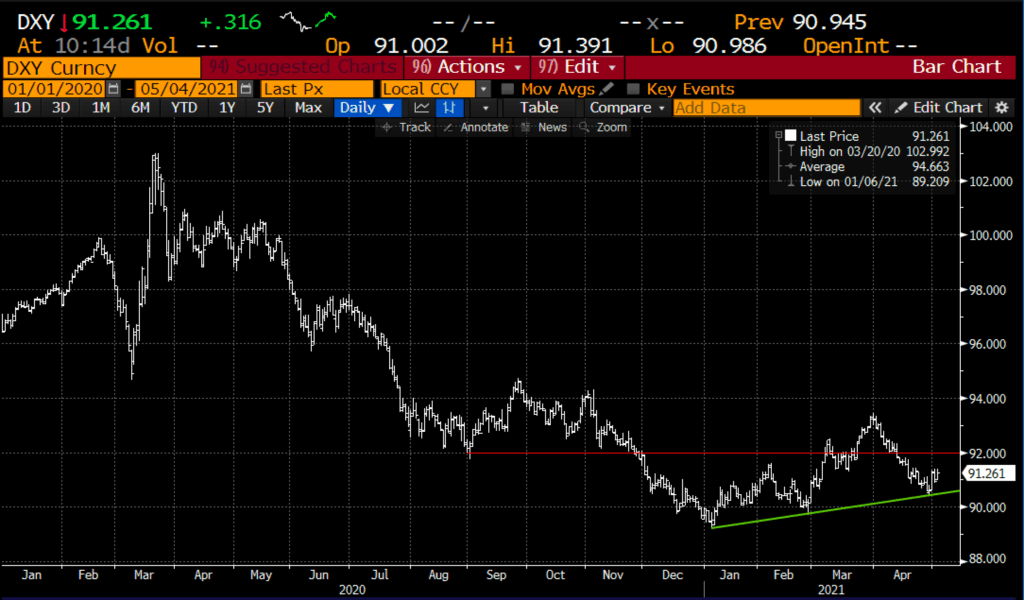

DXY (USD)