On this episode of Okay, Computer, Dan and Joe Marchese, Build Partner at Human Ventures, discuss Disney’s battle to keep up with Netflix in the streaming wars (2:00), Netflix’s execution on its new ad-supported tier (6:00), the potential impact of the Justice Department’s new antitrust lawsuit against Google over its digital ads dominance (11:00), what industries are most likely to see M&A activity this year (16:00), why Joe is still bullish on Roku’s future (18:00), Twitter’s plunge in ad revenue and why many of the wrong people were laid off (21:00), if Snap could be a major beneficiary from Twitter’s woes (23:00), why Meta needs to re-focus on commerce (25:30), the strength of luxury brands & growth of top-shelf tequilas (29:00), reshaping the exhibition of movies (33:00), and the state of corporate giving (36:00).

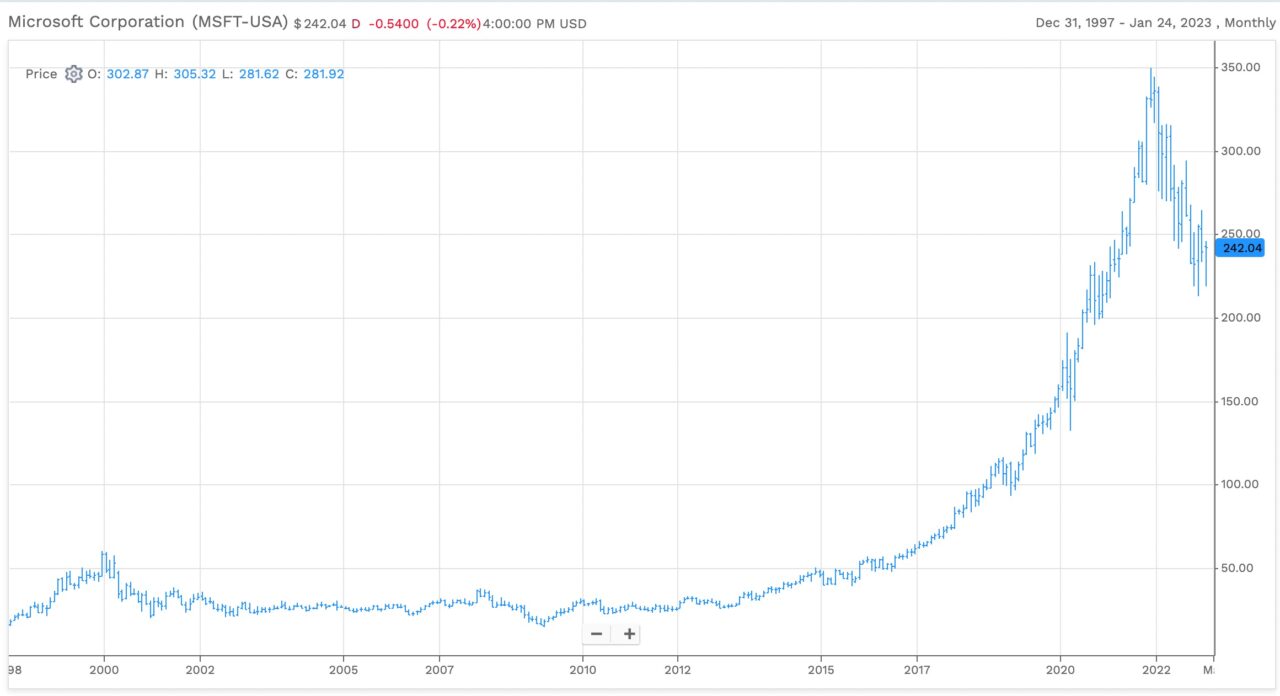

As discussed in the episode, a look back at the long “sideways” period for Microsoft’s stock–and its dramatic rise following Satya Nadella becoming CEO in 2014:

Check out the companies referenced in the episode:

Please rate and review and share it with your friends as this will help people find it.

And as always we want to hear your feedback. Please hit us with any comments at [email protected], and follow us at @OkayComputerPod.

We’re on social:

Follow Dan Nathan @RiskReversal on Twitter

Follow @GuyAdami on Twitter

Follow us on Instagram @RiskReversalMedia

Subscribe to our YouTube page

Show transcript:

Dan Nathan: [00:00:38] Welcome back to Okay, Computer. I am Dan Nathan. I am here with my good friend Joe Marchese. Joe is the build partner over there at Human Ventures, but that does not encapsulate all that you are, does it, Joe? [00:00:48][10.1]

Joe Marchese: [00:00:49] I mean, I hope not. [00:00:51][1.5]

Dan Nathan: [00:00:51] You and I have a lot to talk about. I’ve been trying to actually get you on CNBC. I’ve been trying to get you on the pod. You’ve been running around just launching Komos as you launch Komos Tequila in Paris. I didn’t get the invite for whatever reason, but you were spending some time there. You’re out at Sundance right now. We’re going to talk about the future of the movie industry. And then I think you and I are going to be catching up a little bit in Miami and L.A. this week. We got a lot of catching up. [00:01:13][22.2]

Joe Marchese: [00:01:13] You know, I love New York. It is my home. It’s my forever home. It’s number one in the world for a reason. But if January, February are decent months to be other places, if you have to leave New York, if you absolutely have to go away from New York, that’s probably the months to do it. [00:01:27][13.5]

Dan Nathan: [00:01:27] Yeah, no doubt about it. And again, there’s been a lot going on though, in the spaces where I think that I often lean on you for explaining a little bit of your past expertise. You sold a company to Fox and you ran their ad business for a very long time. You had at your disposal, I think, billions of dollars in ad dollars. And and there’s a lot going on in the space right now. And I thought our listeners might appreciate hearing from you. There’s a lot going on with Disney. There’s a lot going on with Netflix. You saw that quarter last week. You saw what they had to say, you saw what they had to say about the progress of the ad supported business. So you and I haven’t chatted on that a little bit. We also want to get I don’t know if this is just hit the tape right now. And I know this is an evergreen sort of story that the Justice Department is focused once again on Google’s ad business. So their ad tech business in particular. Where do you want to start jump ball here, Joe? [00:02:13][45.7]

Joe Marchese: [00:02:13] Funny you said I had billions of dollars at my disposal at Fox. I wish it was at my disposal. You know, we had a better sales team that had to go out and sell multiple billions of dollars in advertising to, you know, the bigger brands, mostly to the agencies. But the Super Bowl, the World Series, The Simpsons FX National Geographic. It’s an interesting world watching everybody get into the ad business right now when TV’s been there for so long. And then we got the Super Bowl coming up right now. So they’re on the Disney side. [00:02:42][28.8]

Dan Nathan: [00:02:42] I think it’s interesting in a way, because when I think about it through the lens of the stock market, you know, five years ago, I mean, this is a company Bob Iger laid out a path. They made acquisitions both on content as far as technology was concerned, and they really were moving towards this world where they’re going to be competing more and more with Netflix from a streaming standpoint. It seems like it went from a story that was very clear pre-pandemic to when the pandemic hit. The businesses just kind of got thrown up in turmoil, whether it was the parks and whether it was the networks business. And here we are now, it just seems like it’s a massive reset with Iger back and the fact that he has an activist nipping at his heels I think is pretty interesting. [00:03:21][38.4]

Joe Marchese: [00:03:21] Yeah, the idea of everyone was chasing Netflix at one point because it was getting tech multiples on valuation and money was free, distorted a little bit of what the business model was overall. You point out, and it’s not just Apple, Amazon, the history of entertainment is basically entertainment companies owned by businesses that have other lines of revenue besides entertainment. GE owning NBC or before. I mean, it goes goes back and back and back. I think the RCA or the radio, the actual radio builders owned most of the radio stations because they needed a reason why you’d want to buy radios, right? Hardware. Like that sounds an awful lot like Apple having content because you want they want you on their phone. So I think that’s like everything that’s old is new again. Media is a hard business to be in because it’s hard to monetize for the value that it creates in the world. There’s outsized impact. I mean, look at our favorite topic these days in a lot of the media is Twitter. Twitter has outsized influence in the world, but under size monetization to its influence, right. That’s just that just is and so you can see people have that. So now take that and tie that in to what’s happening with Disney. Everyone was chasing Netflix to a single business model of streaming and now Netflix is actually coming back to the market saying, no, we need more revenue streams than just subscription streaming. We’re going to need advertising. And so why the market is reacting to Disney so adversely, given that they actually have the multiple revenue streams, they have the IP, they have the streaming, I would put them as having more of the ingredients compete on all of those fronts. So yeah, I think that’s it’s hard to see why you’d have so much of a negative reaction to the Disney side versus everyone else. [00:04:57][95.2]

Dan Nathan: [00:04:57] Yeah, I think it has to do with the complications of all those different moving parts in the business. And when you think about Parks situation in China, it was in zero COVID for three years. When you think about some of the different operating businesses that they have and the pressures that are going to be on them. I totally get that. I mean, listen, when I start thinking about Disney from an investment standpoint, if you’re looking at the 2024 estimates here, you’re seeing double digit earnings and sales growth trading at a multiple that probably a market multiple, which the stock prior to the pandemic used to trade at a premium multiple. And again, I think your point that you made is a great one is that a lot of these older media companies were chasing that Netflix model because they saw the multiples that were being assigned to it. And so it’s funny to come full circle here. So Netflix forever said they would never do an ad supported model. Right. So let’s talk a little bit about that, because I think you came on when they announced that last year. You came on Fast Money. We talked about it. You were actually a lot more optimistic than a lot of voices that I heard in media about the prospects for that working out for them. And when you think about the quarter that they just reported and the sub growth and what they had to say about this launch of this product, I think there’s a good reason why this stock is up 100% from its lows, its still down considerably from its all time highs. But it has to do with the fact that they’re doing better, at least in and around the edges of just this ad supported model. And it doesn’t seem like it’s really cannibalizing some of their other subscription models right now. [00:06:24][86.9]

Joe Marchese: [00:06:24] It’s very, very, very early. I mean, everyone at Netflix will say the same thing and they have a amazing cushion that is Microsoft with whatever the minimum guarantees are there. I don’t know if it’s out there in public or like whereas but we know they’re high, so that allows them a lot of leeway. And then also, I mean, look at all the tailwinds that Netflix will have with ad supported. One, there’s not enough places to put ad dollars. If you look at television, something like 82 of the top telecast in television last year, in 2022 were NFL. So basically you have sports and you have news. You don’t have much else to put advertising around and the brands are still spending just as much money. We’ve talked about it before. The corporate balance sheets are very healthy going into the end of 2022 and cash positions were very healthy. So big corporates have only a couple of things they can spend money on. They can spend it on R&D, they can spend it on M&A. I know we’ll get to some of the trouble of big guys like doing M&A right now, or they can spend it on customer acquisition and brand building, which is really advertising. So where do you go put that money? Netflix being a new opportunity. It’s almost like the toothpaste is being squeezed as ad inventory was shrinking elsewhere and that’s looking for a new home. So those are all the tailwinds. I’d say the headwinds are that the not so secret part of advertising back to the billions of dollars we would sell at Fox was that a lot of times you were selling these culture creating moments. You want the halftime show, you want an integration into The Simpsons, you want FX to do a thing with the characters, and then you would pay for it in 32nd spots. You’d pay for it in commercials because you don’t know how to value that cool culture creating thing in the middle, right? That that’s what we would call in the industry integrated marketing, right? That stuff that that sponsorship. And then when you saw an ad for the 40th time, you saw a Ford ad, that wasn’t a mistake. That was just how they were paying for the cool stuff. When you’re in Netflix’s position right now, they can do some of that, but they can’t do a lot of it. They don’t have the Olympics. They don’t have these tent poles to do the integrated. They have Stranger Things. But you know, how often can you do something integrated into it? They have a ton of tailwinds. Their headwinds are going to be what are they going to innovate on, on what you buy, because they’re not going to allow people to see the same ad 40 times. So people won’t be able to spend as much money. The total number of households will be low. So you’ll have a frequency problem in the beginning. So I think their biggest challenge ahead of them and they’ve got a great team to do it. Jeremy Gorman very, very good. Peter Nailer knows exactly what he’s doing, creating a market for ad dollars. How do you innovate on what the agencies are buying and the brands are buying? And then what is going to be that juicy center that makes them buy and without having kind of the live or kind of these cultural moments which they do have when they release new shows. But there’s a long cycle to integrating into shows. It’s it’s months, if not years. [00:08:54][150.0]

Dan Nathan: [00:08:55] I watched NFL all weekend as you did an Apple Plus and Apple music really dominated a lot of the advertising for those point. They are leaning into those cultural moments. They are doing this Super Bowl halftime show and then they had that ad with Timothy Chalamet. Did you see that every hour on the hour about all their original programing? And so to me, I think that that’s what makes this game a lot harder. It’s not too different to me. Thinking about Tesla was this kind of early leader, if you want to use that as the kind of equivalent of Netflix and streaming and original content, and now all of a sudden you got the big dogs coming in and the competition was always part of the Bear case, but it wasn’t there yet and it wasn’t there in the right ways. And so I actually feel like Apple can continue to have one hit for every ten show that they put up because they know that they have a billion and a half installed base of users. When you think at Netflix, they have 230 million users worldwide, but those use are there for one reason. They’re there for that content. Right. And for that library. And that’s why I think competition is really that much more difficult for the companies like Disney or Netflix that are in the business of content versus these platform companies that are layering on another service that’s being subsidized by something else. [00:10:10][75.7]

Joe Marchese: [00:10:11] Yeah, that will for sure be the number one challenge in the streaming business is that they have to make money in just streaming. Like Netflix does point out, very rightfully so, that it makes money in its streaming because that’s its core business. But these other businesses don’t need to make money in the streaming. Even at Disney, which has parks and other revenue line items. So question is, where does that end up? And we still haven’t figured out what advertising on what is called CTV connected television. Everything, everything people at home think about is streaming on your on your television. How is that experience going to work? A year from now, two years from now? Is it going to be controlled by the app that you’re in? Is it going to be controlled by your Internet service or the TV that you’re watching it on your Roku or your Apple TV? There’s still so much to be figured out. It’s a bit of the Wild West right now, so that’ll impact everything. [00:10:54][43.1]

Dan Nathan: [00:10:54] All right. Let’s move to this. DOJ suing Google and their ad tech business. And again, the EU has been all over this for a while. We also know that we’ve seen this for decades. It started with Microsoft and the DOJ. And I guess the big issue, I would say from, again, a stock market perspective, if you go back and look at the history of Microsoft, all the dealings with the government and the antitrust stuff, it really kind of helped their competitors as they were bogged down with that sort of stuff. You think about in the 2000s. I mean, you know, Microsoft just kind of missed the Internet, right? And then they missed mobile after that. And it was just kind of a string of things. We’ve been talking a lot about this Chat GPT, actually you and I were out to dinner, I think it was about a month ago, and you were like, you couldn’t even focus. You were so excited about messing around with that app and it was doing all these cool sorts of things. Do you feel like, you know, again, we can all see the consumer applications, the enterprise ones are probably harder for some consumers to figure out here. But if you’re Google and you’re thinking about this and you’re kind of 90% of your revenues come from search and advertising, right? And you think about how this technology could be really disruptive and you think about how Microsoft has invested in open A.I.. I think they just add another 10 billion in the deal, how they’re going to integrate it across the cloud, across Bing, across a whole host of things. Is this going to be a huge threat to Google and then add on this regulatory stuff and their inability to kind of buy stuff and then the newfound focus on costs? Right. We know that they’re cutting jobs and the like. Is this going to be like the perfect storm for Alphabet right now? [00:12:26][92.1]

Joe Marchese: [00:12:27] Let’s go way back to where you started there, which is like Microsoft missed the Internet, which I would challenge and say they seem to be doing pretty damn good right now. But even before chat GPT three, their market cap looked pretty good, right? In terms of where they were sitting. I think the narrative going back to when Microsoft was dealing with the regulatory is that it slowed them down enough for things like Google to pop up for competitors to enter the market, for Chrome to take over. So, you know, could that happen now? Sure. My first reaction when I saw that this was going to happen was this feels like four years ago or five years ago. This is talking about demand side and supply side publisher networks like I think double click and ad now and things that are throwbacks in the ad tech industry. If you think about it, if I’m Google, you’re looking at this and saying, well, Microsoft just bought Zander and is getting back in the ad business so I’ve got a $2 trillion competitor right there. Amazon is a monster in the ad business right there. They control the advertising, plus they sell the products that that seems like worse than having that publisher side. So if I’m Google, I’m looking at it going, this will be a while. I’m not really sure what the solve is. And yes, I mean, like I couldn’t even imagine what it would be like to have to both do that and now compete on this new ground where there’s AI is going to change so many things. I think there’s a lot of questions as to if air makes a couple of mistakes on the things it recommends people. Does it get slowed down very, very quickly? Google has that in the background. They just haven’t released it because there’s risk to it. It answers things confidently and wrongly sometimes. [00:13:52][85.9]

Dan Nathan: [00:13:53] Yeah, I just want to make one point here, because I know you’re not the stock market guy. You’re the media ad guru wiz. Microsoft in 2000 topped out at $57. Okay? It did not cross the $57 range, you ready for this, until early 2016. Satya Nadella took over for Steve Ballmer in February of 2014. When you look at this wasteland of Microsoft Sideways action from 2000 until 2016, that is just crazy and that actually speaks to that. And so I guess I bring this point up, there’s a chance that this could happen to Google. I mean, like it could easily happen to Alphabet. [00:14:33][39.5]

Joe Marchese: [00:14:34] Yes. I get your on the stocks in the stock markets. I totally understand. Although I would still go back to where we ended up. We’re still here right now with Microsoft being a leader and for a lot of reasons. And yes, Satya has a lot to do with that. Maybe all had to do with that. But I think that the big part of why it went sideways, the question is, are you saying that the DOJ distraction caused them to go sideways or was it platform change going from web to mobile and going from web to mobile was really I remember the Microsoft fundamentally, they weren’t trying to get into mobile. In mobile, you had Apple one on the device and then Android one on the operating system on everyone else. And then that left Microsoft in an in-between phase. And so they were just nowhere in the middle. They they didn’t have that store and they didn’t have Facebook. Right. Which became the dominant social media platform. And so I think the sideways was more what secular trends were happening at the time that Microsoft couldn’t tap into. But then you had the whole decade going back to when that chart starts going up into the right and Satya’s when Enterprise, you had Amazon Web Services becoming the largest business, really the driver of Amazon’s business overall. And there are tons of people who didn’t want Amazon to be their web. Service provider because they compete with Amazon. So here comes Microsoft with the solution, and now all of a sudden that’s a massive business. So the question you’re asking about Google still comes back to do you think this causes a sideways move in the business? I don’t think it’ll be the DOJ that caused a sideways move in the stock or business. I think it will be is AI truly a new platform the way mobile was a new platform that TBD? Is Google not prepared to capture whatever upside there is in that in consumer enterprise? And I think they very well could be. [00:16:05][91.5]

Dan Nathan: [00:16:06] Let’s talk about M&A a little bit. I’m just curious if you think about a newfound regulatory fervor in the DOJ, what sort of M&A could we see going forward here? I know that during the last presidential administration, there was kind of a thought that you could probably get some stuff done. This one maybe not so much here. I’m just curious, are there some things out there? We’ve seen private equity pay some multiples, definitely an enterprise software that, you know, look rich to to the public markets here a little bit, but there’s a lot of cash there. Are we likely to see some strategic M&A? Are there any areas that make sense to you? [00:16:40][34.1]

Joe Marchese: [00:16:40] First of all, the entertainment industry, the back to what we were talking about before is not done. There will be combinations or recombinations of media assets to get bigger or they will get acquired by whoever can acquire them. I mean, that is the question that you’re asking, which is, sure, any of these big guys would love to acquire Netflix as Netflix one is it possible for sale? Or two, could they get it through and DOJ? Is Disney to acquire again, I still think it is the best position in having multiple revenue streams and the best IP library to build off of. But like what else would they be allowed to do? What would their debt allow them to do? And how does that change? And this is where it gets out of my area of expertise and into yours in a high interest rate environment. What’s going to happen to all of these companies that have high debt loads on their balance sheet because they were all trying to fix the business of being in the entertainment business in a in a headwind environment of advertising and a headwind of trying to acquire streamers and the cable bundle going down. And now they’re going to have a headwind of the debt on their books is going to start to become more expensive. So then what happens? [00:17:39][58.7]

Dan Nathan: [00:17:39] You make a great point. So Disney now starts to look like some of these wireless carriers. They you know, when AT&T was buying Time Warner, they were loading up with debt to do that. I mean, we’ve seen it across the board here. So I think that’ll definitely be a headwind. And I think that’s one of the reasons why you’re seeing some activist agitation with like a Disney. I mean, what Peltz wants them to do is cut their cost pretty dramatically and pay down a bit of that debt and rationalize some costs here. I just look at some of these properties, and I couldn’t believe that Roku had the sort of market cap that it had. I used to say on CNBC, like throw it on the trash heap of useless tech junk, maybe with like a TiVo and stuff like that. That seemed pretty obvious to me. I know that you’re going to tell me something different as it relates to advertising and the network that they have there, but I just don’t see a future for it. But I look at like. [00:18:23][44.1]

Joe Marchese: [00:18:23] Let me let me start on the Roku side, because, I mean, look, there are so many valuations that didn’t make sense for a couple of years there, which we can all agree on. That said, being the operating system on television and home, all of these people who are in the video business, Apple being in the video business, Amazon being in the video business, AT&T buying Time Warner being in the video business. They just want to be your operating system in your living room so that they thought they had to be in the video business. Like cable for a long time Comcast and Cox and all the others would say our Internet delivers 90% margin is a 90% margin business and our video services are break even or losing money. And so why do they still deliver the cable bundle? Because you would sign up for your Internet based on who had the best cable bundle. Direct TV Sunday ticket is like the most sought after thing in pro sports rights, which is like the king of all NFL rights. Right. And Sunday football. That’s because the reason they pay for it is that you have the channel. You have to have the channel because you’re going to get your cable bundle. And that’s the operating system in your home. That was the whole game in terms of what the value is for these rights. And so Roku was the operating system in people’s living rooms. Now most people don’t know it. There’s also a bit of an offshoot of Netflix, like Netflix needed streaming devices in people’s homes on was first getting started and Anthony did something genius in terms of creating Roku. Now Roku is facing the same challenges Netflix was. It didn’t have real competition in the beginning. It started to give its operating system to TV manufacturers and that was an amazing move. But it is a move you can make once. Now now that’s becoming commoditized. So what happens next? I think Roku has a chance to be a great platform right now. The difficulty of being an ad based business and something that is consumer friendly is one of the hardest things in the world. I think maybe Google is the only one who’s pulled it off, which is why they got so big. They would serve people’s needs and be an ad based business. There is a ton of value in being the platform, is all I’m saying. Whether or not it can get realized now that there’s massive competition is up to the leadership there now. [00:20:13][109.8]

Dan Nathan: [00:20:14] Well, yeah, and I would say it really is just who’s going to buy them. I mean, like, listen, they had one profitable year. It was 2021 and it was a massive pull forward. Right. We all know some of the dynamics that were at play there. This has a $6 billion enterprise value, which, again, just as an asset, if you tell me, it looks kind of cheap, but it’s expected to lose money for the next few years and you’re probably talking at best, high single digit revenue growth. You tell me. It just feels like it got crowded out. And I don’t really know the business that well, but I look at this and say, if there’s a strategic buyer out there, you’re paying $6 billion. They have 2 billion in cash, 1.3 net on a $7.4 billion market cap, doing a few billion dollars in sales a year, just growing at a low rate. So there’s got to be some strategic that gets for it but as a standalone, I just don’t see it going forward. Which leads me to, let’s say, some of these other ad supported businesses. And again, you saw The Information reported this last week that Twitter, their revenues in Q4 were down maybe 35 to 40%. And I’m just curious how much you think is specific to Twitter, maybe what’s going on with advertisers fleeing? Because Elon Musk, he’s been a bit of an agitator, to say the least there. I’m just curious, is that a trend we’re going to see here? [00:21:28][74.6]

Joe Marchese: [00:21:29] I have a very different view on why Twitter is down, as much of it’s down. And I think it’s actually even different than what people have been saying about Elon or the safety of the space. I mean, that’s all very important. And there’s no doubt brands do think about that. But let’s be honest. I mean, there’s a controversy over some crazy video on YouTube everyone pulls their advertising for like four days, and then when no one’s looking, they start advertising again. If it’s effective, people advertise. They’re like, there was all sorts of issues with Facebook and then, you know, but it was effective and working and the ad dollars go back up. I think what’s happening with Twitter is much more of what I was getting at earlier, which is they got rid of all of their sales and marketing people and all the people who are doing interesting things on the platform. So buying Twitter just to buy impressions wasn’t really ever that important, but buying Twitter to buy the NBA All-Star Game for the weekend and you’re going to integrate into it. But that takes people and creative people. It takes this integrated marketing team what all look like a cost center to Twitter, right? Like all of these people who would be like, all right, the Grammys are coming up. You’re going to want to buy it. You’re going to get these we’re we’re going to do a cool campaign. We’re going to work with your brands to do this. That big chunk of revenue. There’s too many people that are saying, look at how many people were able to get laid off at Twitter and it’s still functioning fine. Well, yeah, the feed still runs down. Yeah, like the revenue got cut in half. And I think that more of the revenue got cut in half because there weren’t the creative people to do that culture integrating stuff that Twitter is actually very good at. That’s the rest of the business. [00:22:52][83.7]

Dan Nathan: [00:22:53] Well, let’s talk about SNAP here because again, I think it’s interesting that Twitter’s not a public company, so they’re not going to be reporting earnings. And so that’s kind of some internal data here. But I look at SNAP and they’re expected Q4 results, and I think they’re going to report at some point early next week are expected to be flat year over year. And that’s really interesting because last year, Q4 2021, their revenues were up 42% year over year. Right and if you’re thinking about Twitter internally saying down, let’s just say be conservative down 30%, that SNAP number probably seems too high. Or is that is that the probably the wrong way to think about it? And then for 2023, expected revenue growth, you know, high single digits or something like that, is this are we going to see them just kind of slash this again and really just kind of reset the bar for the balance of the year so they can start meeting these numbers? [00:23:40][46.9]

Joe Marchese: [00:23:40] SNAP is the toughest one for me because, one, I think that could be a beneficiary. They still have a lot of creative ad people over there, so they give you a beneficiary of some of the pullback from Twitter dollars have to find a home. I have said a couple of times that I just think that SNAP is not in the same advertising business as the other platforms Amazon, Facebook, Google, like the long tail advertisers who are doing performance advertising. I think the reason why Apple ad tracking hit certain platforms so hard is because it just was trying to give credit to these mass impression reach, and that’s not Snap’s business, Evans said So many times that SNAP is for real friends. It’s not a media company is not for influencers. It’s a communication platform which are not typically communication platforms. They’re not typically your best advertisers. People don’t want advertising in the most intimate kind of communication. But SNAP has is incredibly innovative, AR incredibly innovative like Filter, like the formats on SNAP are very interesting geolocation, so it shouldn’t tie to the trends that we’re seeing in advertising overall shouldn’t affect that. One is not there’s not a big enough piece of the market and it should benefit from some of the pullback from Twitter and its advertising is about innovation, which is expensive and hard to do because you have to sell it through each time to the brand. So I don’t think it’ll be down because of the trend. And so it could beat that number and kind of come up. But I think long term for SNAP it, it shouldn’t be an ad supported only business or 95% ad supported business. I think there is a better path like some of the streamers were only subscription and now they’re doing advertising. I think SNAP needs to go the other way and figure out multiple revenue models besides advertising or new ad models that work, because being an in the impression business will be bad for them over the next 3 to 5 years. [00:25:19][98.2]

Dan Nathan: [00:25:19] All right, last one here before we hit some of the stuff that is more near and dear to your heart, which would be Tequila. Maybe it’s some Jake Wood stuff. We love Jake Wood. We love talking Jake Wood here. But talk to me about Meta here. And I just used that expression, you know, kind of identity crisis. I mean, when you think about this, stock lost almost 80% from its highs in late 2021 to its lows last year. It’s rallied 60% or so. It still has a $360 billion market cap here. The stock has never been cheaper. They’ve taken some cuts. They’ve changed course a little bit. I mean, investors were very concerned about the spend on Metaverse, whatever that meant to the tune of tens of billions of dollars they hired like crazy. Now, they’ve been firing. They’ve kind of muted some of their commentary about the spend. And I just wonder, what do you think we’re gonna hear from this company in 2023? [00:26:06][47.0]

Joe Marchese: [00:26:07] I think the bigger thing that ties in what you’re saying about Meta, why they went into Metaverse because they didn’t control the phone that it was on with Apple. They didn’t control the platform. What Google and Facebook and now Amazon to some extent and others have done they’re not advertising companies. Right. They have literally inserted themselves into the flow of commerce of the economy. Everyone talks about credit card fees. And like the 1%, 2% of credit card fees is like a tax on. Facebook and Google are in the flow of almost all e-commerce, right? Like you search for an Amazon, you search for thing, then you end up buying it. Someone gets credit for that sale somewhere, especially if you click through. So Facebook was in the flow of commerce through its Facebook blue platform, through Instagram knowing more about people having a network, it has to get back into the flow, like it has to believe commerce will flow through the metaverse at some point. That’s how they’re going to insert themselves into the flow of commerce. I don’t think that happens in 2023. And if that doesn’t happen in 2023, consumer spending hasn’t really changed since Apple’s ad tracking thing came into play, right? Apple’s ad tracking thing didn’t come into play. And then consumers like, oh, I guess I won’t buy anything because no one’s advertising to me. Consumer spending stayed about the same. So is it that these companies just inserted themselves into the flow of purchases in such a way that they were getting credit, or was it just funding impulse purchases or was it shifting consumer spend from one thing to another? Because like, I don’t know that there’s any macro level evidence that the economy got less efficient when ad tracking went away. And so this is a big question for how much is really getting over credited to the people who can claim credit for sales versus what really drives sales. I don’t see that coming in 2023. I do think for every company this is something I go into and it’s probably a good transition into the startup side of the world, which is these are the big existential questions for SNAP, for Twitter, for Amazon, for Facebook, for Google, all ad based businesses, which is insane to think about like how big that is. But for every small company in the world, their first thought is, how do I acquire customers? How do I build a brand? What’s it like? What do I buy? And so the other side of this coin is you’re going to have a whole group of businesses coming out that are saying, okay, it’s not as efficient anymore to go buy my first consumers. I can’t test product in the same way. And that’s something I think we’ll spend a lot of time thinking about 2023 [00:28:23][135.5]

Dan Nathan: [00:29:10] Before we get to the start of all this talk tequila here. What did you learn? You spent a lot of time with Richard Betts, CEO of your fine tequila company. Tequila Komos here, CKBG, You guys were just launching, it sounds like in Europe it seems like luxury tequila is just gone off the hook. I see all the celebrity back stuff or whatever. You guys have chosen not to go down that route, you just focused on product and you’re focused on just vibe. I feel like like I’m in I’m in the Commerce family. And the good news about you as a guest is that I don’t have to send you like we send all of our guests a bottle of Komos because it’s just kind of coursing through your veins right now. [00:29:56][46.1]

Joe Marchese: [00:29:57] I like to joke that if the New York City Marathon handicapped for the amount of tequila you drank during training, I would have won so [00:30:03][6.0]

Dan Nathan: [00:30:05] What do you think wait first things first. I don’t know if you’ve been on since you ran the marathon, but you ran the New York City marathon in November in, what, like 307 or something like that? [00:30:14][8.6]

Joe Marchese: [00:30:14] 2 hours and 57 minutes? How dare you? The cracking three was my the whole point. [00:30:18][4.0]

Dan Nathan: [00:30:19] And I can vouch for the fact that during your training in air quotes, while you got a sub three hour marathon, you probably drank gallons of Komos tequila along the way. So you are like a super hero in my mind here. Talk just a little bit about what’s gone on in luxury spirits in general and what you kind of found out by launching in Paris. [00:30:42][23.5]

Joe Marchese: [00:30:43] First, you look at what’s been happening in luxury. We’ve said it before, it the two richest people on planet Earth very recently were Bernard Arnault and Jeff Bezos, the highest margin products in the world. And your margin is my opportunity. The opposite sides of wealth and luxury is one of the few things that isn’t relying on search or Google ads or Facebook ads. Luxury isn’t just LVMH like Nike, like brands that stand for something. They attract consumers and they have ability to charge a margin. They have trust over time. Brands matter, I think is the bigger point, which brings us to Komos and tequila, which is when you craft a product as well as Richard. My partner Komos is Richard Betts. He’s the CEO, the maker of the product, and he crafted something amazing. And so then what you need is you don’t just acquire your customers over and over again through search bidding and transactions Like you could do that sometimes, but that’s not where you’re looking for. You’re looking to build a brand based on the quality of your product. And so tequila is a really interesting industry because every celebrity and their brother has a tequila that they’re invested in because the market took a signal from the success of George Clooney, from the success of Ryan Reynolds that like, Oh, all I need to do is sprinkle a little bit of celebrity reach and influence on top of any tequila and it’ll be great. Or it could be even a great tequila will partner with a family, make a great tequila. That wasn’t really happened. Like, what really happened was is a huge logistics and operations has to maintain quality craft something that the people taste and are wowed by. And then you have to stand for that over and over and over again. And so that’s how you build a brand. And so the industry for tequila’s pretty interesting because it’s just starting overseas. So basically you go to Europe and it’s a fresh slate of people who the last time they remember drinking tequila was in college and if they like salt off their hand and squeezed the lime and made a terrible face. And so that was the U.S. five years ago, ten years ago was everyone thought that. And then they started tasting this amazing spirit that just made from agave. It’s distilled, it’s refined, it’s it’s aged. And so you realize that the marketing challenge for that is, well, how do I tell a whole continent of people, no, this isn’t what you think it was. And that is just such a fun and interesting challenge. And when you think about it, what’s happening in tequila isn’t that different than what’s happened in luxury. Rest in Peace Virgil Abloh was the creative director of LVMH of Louis Vuitton, and no one was like, well, Virgil Abloh is a black man from America. Well, that’s not very French. No, they said, What an amazing creative genius to bring this brand forward. And kudos to Bernard. I know to trust him, to bring the brand forward because man with his stuff, amazing. And tequila everyone has been saying like or any spirit, it’s like, can we bring these luxury brands forward versus just saying everything has to stay the same in the bucket it’s always been in. And that’s interesting. It turns out that works very well. [00:33:20][156.8]

Dan Nathan: [00:33:20] It turns out that product works well for me, and I’m happy to be part of the tequila Komos family here. All right. Let’s talk about Kinema. You and Christie are out at Sundance. And what did you learn? And let’s talk about Christie’s business for a second. I hope someday she will accept my offer to come on the pod and we can talk about ienema here a little bit because she built this company, you know, through a very difficult time during the pandemic. And a lot of ways it worked really well in the pandemic. And now we’ve had all these changing dynamics in the movie business. Talk to us a little bit about Kinema and what you guys are learning out there in Sundance [00:33:51][30.6]

Joe Marchese: [00:33:52] The idea for Kinema is so kind of basic is that the exhibition of movies is a very good business, but the movie theater business is very challenged, right? It’s hard to support the costs, like it’s only blockbusters going in, but people like going to see movies and people like seeing movies together. The idea of going to buy a ticket, you know, there’s a theater chain in London that we love called Curzon, which almost everything in the theaters also released day and date on streaming. And their theaters are always still full because you weren’t going because you couldn’t watch it at home. You’re going because you wanted to go do something. You want it to go to a movie. You wanted the experience of a movie. And if you think about it, the industry also wants that. The person making the film, if they had a choice, it would love for you to watch it in a theater where you’re not distracted by your phone and you can really get the full experience. They don’t want to make you. I think that’s what the industry is doing wrong right now. It’s trying to force you to do one or the other, like, Oh, this will only be in theaters. And I think the windowing thing is going to be wrong. I think there’s going to be new definitions of the exhibition window. And then the other part for the industry is if you make a hit movie for streaming, you make no more money. Maybe on your next deal you can get a better deal. But if it gets a million views or 10 million views on Netflix, you’re making the same amount of money. Talent and the agents are all talking about it right now in the industry. And it’s a part of the subject here at Sundance is what is exhibition going to be? Because it used to be when you made a movie, you could go out and you’d go to the late night shows or you’d post things or you’d hustle for the movie because you’d want to sell tickets, because the more tickets you sold, the more money you make. Well, that doesn’t exist in streaming. So I think there needs to be a new and this is where Christie’s massive insight was with cinema is, can you open up new exhibition inventory in the world? Can you have new places where people go gather and watch movies in mixed use spaces or virtual spaces using Kinema? Then the talent for the film, the studio, the producers could like build in marketing to get people to say, Hey, this is on streaming, but if you want to watch it together with people, here’s a here’s a ticket for $5. It’s an incremental revenue stream for the business. And just like Netflix moved from streaming to needing to do advertising, we’re going to need to go from streaming to figuring out what exhibition looks like in the future. I mean, the technology they’ve built in the base, they built a Kinema and the brand is exactly that. [00:35:57][124.9]

Dan Nathan: [00:35:57] Well, here’s my appeal to okay, computer listeners here, let’s make Kinema a meme stock like AMC. Go out there, check it out, become a host. [00:36:05][8.4]

Joe Marchese: [00:36:06] Lets us do Kinema together. We’ve been trying to get Danny let’s host the Big Short and like and we’ll just watch together. [00:36:11][5.1]

Dan Nathan: [00:36:11] It’s going to happen in 2023 and Christie and I talked about that last year, so let’s do that. So stay tuned for that fans of the pods here,. Alright last one here. I’m going see all of you guys. I’m going to see you. I miss you, Richard. I’m going to see Christie. And I’m gonna see Jake Wood next week in L.A.. Give me a quick Groundswell update. I became a user of Groundswell last year. The platform is amazingly simple and helps me organize some of my charitable giving. And so I know that there’s a lot of other ways in which enterprises are going to be using this. Give us the quick 401 on what Groundswell is and what you and Jake, you co-founded this company, what a year and a half ago or so is that sound about right and where you are with this platform? [00:36:50][38.8]

Joe Marchese: [00:36:50] Yeah, I mean, I just got in my inbox today my note from Groundswell that’s that basically categorized and summed up all my giving from 2022 and I just handed to my tax people and now I don’t have to go through a spreadsheet and mark things off. Think of it as Venmo for giving. I have it on my phone, you have it on yours. I can open it up type of charity and send money and it just goes to that charity. I need to do nothing else and I don’t need to keep track of it. I don’t need to keep the emails I need to give because at the end of the year, it’s all in one place. I can go into the app and go see everything I’ve given to. And what makes it even more interesting is kind of it’s really Groundswell for enterprise that makes up the corporate giving. Corporate philanthropy is one of the largest sources of philanthropy in the world, but it’s very hard for companies to give to any particular cause because no matter how good it causes, 10% of your employees making up that number are going to be against it. Like what? You want to save kittens from cancer? What about dogs? Why do you hate dogs so much? Or what about me? So the idea of giving the money to your employees to give away and you can do this through Groundswell very efficiently. Basically what you’re doing is making it part of people’s compensation, saying, Dan I;m going to give you $1,000 to give to the charities of your choice. We have found nothing but positivity coming back from the companies who have signed on. Human uses it, CKBG uses it, like a lot of our tech friends are starting to sign on because they’re realizing this is a great employee engagement tool and retention for the best talent. But it also kind of improves the NPS score of employees for their employer because the employer is empowering them to make the choices. [00:38:13][82.7]

Dan Nathan: [00:38:14] Well, listen, you are the build partner over there at Human. You’ve helped me build RiskReversal Media so Guy and I are very appreciative that. I know that Christie, Jake and Richard are also very appreciative too, which is one of the reasons why I wanted to get a quick rundown of those companies that, you know, not only are the companies fantastic, the people that are running them, and obviously your assistance in all of that is a big ingredient of that. So, Joe Marchese, thanks for coming by. Thanks for dropping all that knowledge. We’re really appreciate. I can’t wait to see you this week as you have just shunned New York in the January, February period of the winter here. But I will see you in warmer weather here. [00:38:14][0.0]

[2188.4]

Learn more about how Current improves its members’ lives at current.com/okay